The aims of this website are:

(i) to set out proposals for a new approach to the introduction of auto-enrolled pensions in Ireland and to seek support for that approach; and

(ii) to demystify investing in ordinary shares in order to make the world of investing accessible to people without specialised financial knowledge.

I have strong views on both.

Whether you agree or disagree with my views, I would really appreciate hearing from you. Write to me at

colm@colmfagan.ie. I will get back to you as soon as possible.

1. PENSIONS

My views on pensions derive, in part at least, from my chequered employment history.

In 1967, aged 17, I joined Irish Life Assurance Company as an actuarial trainee. It was a 'permanent pensionable' job; however, the prospect of a 'defined benefit' (DB) pension from age 65 was not the top priority for this 17-year old. After finishing the actuarial exams, I moved jobs, then moved again, and again, many times, eventually setting up my own business. Things worked out well in the end, but the promise of a generous DB pension was a casualty along the way. As far as pensions were concerned, I had to fend - and to fund - for myself.

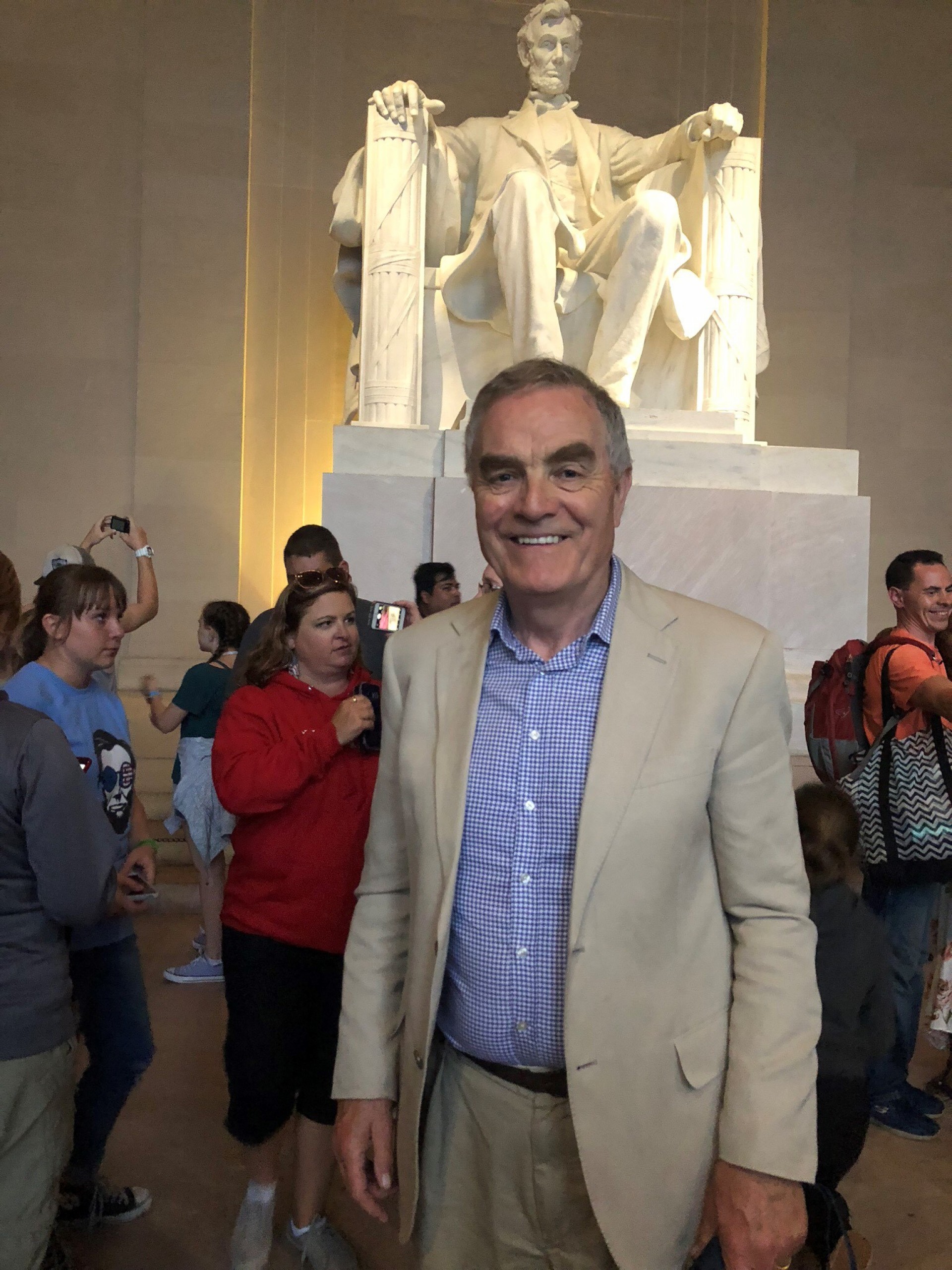

Now well into my seventies, financial security is no longer a worry. I realise that I am one of the lucky ones, though: I have a solid background in finance that has helped me navigate successfully the world of defined contribution ("DC") pensions. Most are not so lucky.

The "pensions" tab of this site sets out how I am trying to apply the lessons from my own experience to help others achieve income security in retirement.

2. INVESTMENTS

My views on investment derive from an even earlier experience.

As a child, I was "encouraged" to learn the piano. From age 8, I cycled seven miles on Saturdays to the local town, Claremorris, for piano lessons. Occasionally, my father, a local Garda (policeman) asked me to bring home the Financial Times (there was no newsagent in our village, Knock). My father died when I was 9. When trying to sort out his affairs, no-one knew what to do about the few shares he had bought during his years of reading the FT. I vowed that I would sometime learn about this arcane subject. I eventually did learn. I discovered that shares are not nearly as complicated as many finance professionals pretend. I believe that people without a financial background can make the same discovery. That is the aim of the series of articles: "Diary of a Private Investor". The focus of the "investments" section of my website has now shifted to my efforts to make financial products safer for small retail investors.

3. ABOUT ME

In 2008, I retired from my last full-time role, as Executive Chairman of Life Strategies, the actuarial consulting firm I had founded 15 years previously as a sole trader, but which employed 20 actuarial consultants by the time I retired. The firm is now Milliman Ireland.

After retiring, I took on a number of part-time Independent Non-Executive Director (INED) roles. I chaired the Board of Standard Life International and the risk or audit committees of subsidiaries of Hannover Re, SEB, Barclays Bank and others, as well as chairing the Trustee boards of two pension schemes, one defined benefit, the other defined contribution. I have now retired from all non-executive roles.

I have just two remaining business-related involvements. One is to help make financial products safer for ordinary savers. The later entries on the "Investment" section of my website and numerous posts on LinkedIn mention some of the campaigns I have engaged in with my friend and fellow retired actuary, Brian Woods.

My second, which is now almost all-consuming, is to try to persuade policymakers of the merits of an approach to auto-enrolled pensions that differs significantly from that proposed by the Irish government. I first devised the alternative approach in 2018, when I made my first submission to the Department of Social Protection. Subsequent developments, including getting joint first place in an international competition in London in 2022, are documented on the Pensions section of the website.

An independent adviser to the Pensions Council concluded that workers' pensions under my alternative proposal would be more than double those under the government's plan; however, that conclusion was omitted from a letter by the chair of the Pensions Council to the Minister for Social Protection, giving Council's evaluation of my proposal. The Pensions Council advised the Minister to reject my proposal. The Minister agreed with the Pensions Council's recommendation. TDs and Senators accepted the Minister's recommendation and my proposal was rejected by both Houses of parliament. The government's alternative scheme is now law. The scheme is projected to start on 30 September 2025, but that date is certain to slip. My hope is that the new government will see the merits of my proposal and will look again at it.

I started my career with Irish Life Assurance, which I joined straight from secondary school. I qualified as an actuary (FIA) through part-time study. A few years after qualifying, I left Irish Life for a brief career as a pension consultant but soon returned to the life assurance fold. I joined Bank of Ireland in 1986 to help it break into the life assurance business, becoming Finance Director and Chief Actuary of its insurance subsidiary.

In 1993 I set up a new actuarial consultancy specialising in life assurance. I called the firm Life Strategies. My timing was fortuitous. The EU's Single Market was making Dublin's International Financial Services Centre (IFSC) an attractive location for new cross-border life assurance companies. I was able to ride the wave. The firm was particularly successful in attracting Italian financial institutions to establish life assurance subsidiaries in Ireland.

While with Life Strategies, I discharged the statutory role of Appointed Actuary under Irish and UK law for more than a dozen companies. I also served as With-Profits actuary in the UK and Independent Actuary appointed by the High Court in Ireland, charged with opining on transfers of life assurance portfolios.

In 2005, I was asked to serve as President of the Society of Actuaries in Ireland, a role I was honoured to discharge for the next two years. I have also contributed to actuarial research. My first paper, in 1977, received little attention at the time but more than two decades later it was recognised as independently replicating the option pricing theory developed by the financial economists Black, Scholes and Merton. In 1997, Scholes and Merton received the Bank of Sweden Prize in Economic Science in Memory of Alfred Nobel for their work. My 1977 paper gets a number of mentions in the 2023 book by Arjen van der Heide, "Dealing in Uncertainty". (See the "News" section of this website).

Back